placer county sales tax 2020

April 21 2020 FROM. The sales tax is assessed as a percentage of the price.

How To Support A Friends Business For Free Business Advice New Business Ideas Financial Help

Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025.

. For more information please have a look at. Check out popular questions and answers regarding property taxes. The December 2020 total local sales tax rate was also 7250.

Sales All sales require full payment which includes the transfer tax and recording fee. Retailers typically pass this tax along to buyers. 3091 County Center Dr Auburn CA.

All cashiers checks must be made payable to the Placer County Tax Collector. Automating sales tax compliance can help your business keep compliant with changing. South Placer County District Transportation Sales Tax Expenditure Plan ACTION REQUESTED Adopt a resolution approving the expenditure plan for a proposed ½ cent 30-year transportation.

ICalculator US Excellent Free Online Calculators for Personal and Business use. Below is a table reflecting where Sales Tax projections are for the current fiscal year as compared to FY 2019-20. Some cities and local governments in Placer County collect additional local sales taxes which can be as high as 15.

The average sales tax rate in California is 8551. Honorable Board of Supervisors DATE. Usually it includes rentals lodging consumer purchases sales etc.

Sales Tax Breakdown Auburn Details Auburn CA is in Placer County. City Rate County. Todd Leopold County Executive Officer SUBJECT.

The highest number of sales tax measures 129 were on the ballot in 2020 while no sales taxes were proposed in 2010. The Placer County sales tax rate is. Community Resource Development Center.

Has impacted many state nexus laws and sales tax collection requirements. The 2018 United States Supreme Court decision in South Dakota v. 1788 rows Placer.

List of Parcels Subject to Tax Sale In December 2021. Tamal San Quentin 8000. The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County.

Auburn CA Sales Tax Rate The current total local sales tax rate in Auburn CA is 7250. The 725 sales tax rate in lincoln consists of 6 california state sales tax 025 placer county sales tax and 1 special tax. No personal checks will be accepted.

While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. The minimum combined 2021 sales tax rate for roseville california is. Exceptions include services most groceries and medicine.

Estimate your supplemental tax with Placer County. The office collects over 230 different taxes including special assessments and direct charges. California City and County Sales and Use Tax Rates.

The Placer County Board of Supervisors has approved a resolution authorizing an agreement that could provide the City of Lincoln up to 117 million to enhance public safety services for city residents. Registration begins at 9 am. The current total local sales tax rate in Placer County CA is 7250.

Rates Effective 07012020 through 09302020. Tax revenue being generated from online sales delivered to unincorporated Placer County has stabilized the sales tax estimates for FY 2020-21. Retailers are taxed for the opportunity to sell tangible items in California.

Appeal your property tax bill penalty fees and validity of assessment date. The County Tax Collector collects taxes for more than 70 different taxing agencies within the county. The base sales tax rate of 725 consists of several components.

The main increment is the state-imposed basic sales tax rate. To review the rules in California visit our state-by-state guide. As the table shows while revenues have increased over the same period in FY 2019-20.

For the 20202021 tax year they are 1079687582. The Sales tax rates may differ depending on the type of purchase. And the sale begins at 10 am.

The December 2020 total local sales tax rate was also 7250. December 20 2021 properties postponed from the October 5th 2021 Tax Land Sale. Property Tax Bill Questions Answers.

The Placer County California sales tax is 725 the same as the California state sales tax. Planning Commission Hearing Room. Placer County California Sales Tax Rate 2022 Up to 775 The Placer County Sales Tax is 025 A county-wide sales tax rate of 025 is applicable to localities in Placer County in addition to the 6 California sales tax.

Placer County set to share more tax revenue with City of Lincoln to enhance public safety. Placer County CA Sales Tax Rate. Tarzana Los Angeles 9500.

Find different option for paying your property taxes. This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price exceeds 100. County of Placer TO.

Luxury Homes Dream Houses Dream House Exterior Mountain Home Exterior

15 Sophisticated And Classy Mediterranean House Designs Home Design Lover Mediterranean Exterior Tuscan House Mediterranean House Designs

John Crestani Review Internet Jetset 6 Figure Side Income Online Entrepreneur Quotes Entrepre Money Management Advice Finance Investing Investing Money

Foto Y Video Para Quinceaneras En Sacramento Ca 916 709 5317 Quinceanera Quinceaner Vestidos De Quinceanera Vestido De Quinceanera Fotografia De Quinceanera

Pin On Tesla Elon Musk Spacex News And Articles

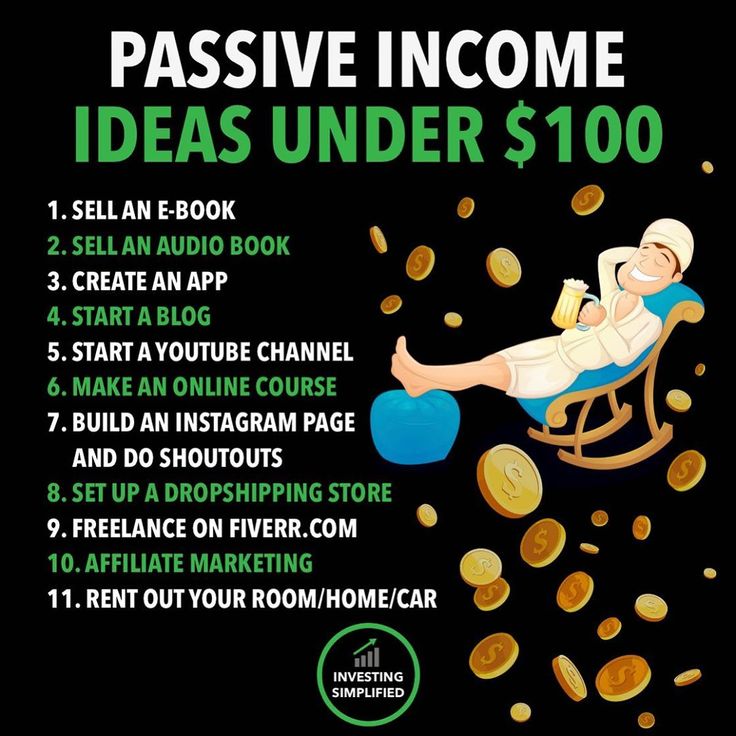

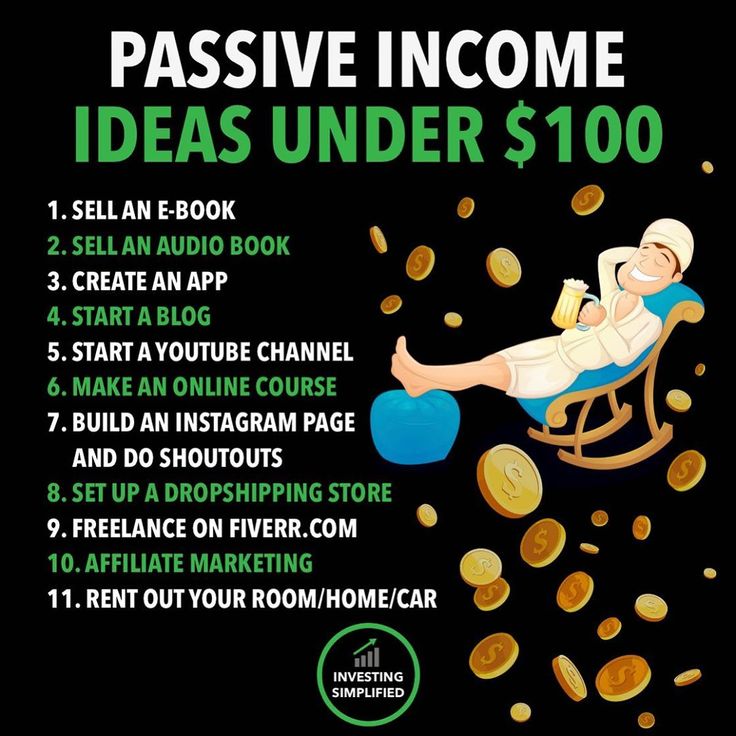

Who Loves Passive Income Passiveincome I Help Local Businesses And E Commerce To Generate Reve Start Online Business Personal Finance Budget Business Money

Esmeralda Bridal Quinceaneras Best Quinceanera Dresses In The Market Quinceanera Dresses Lavender Quinceanera Dresses Charro Dresses